Lic policy jeevan shanti (850)/एलआईसी पॉलिसी जीवन शांती (850)

Today means 23 july 2020

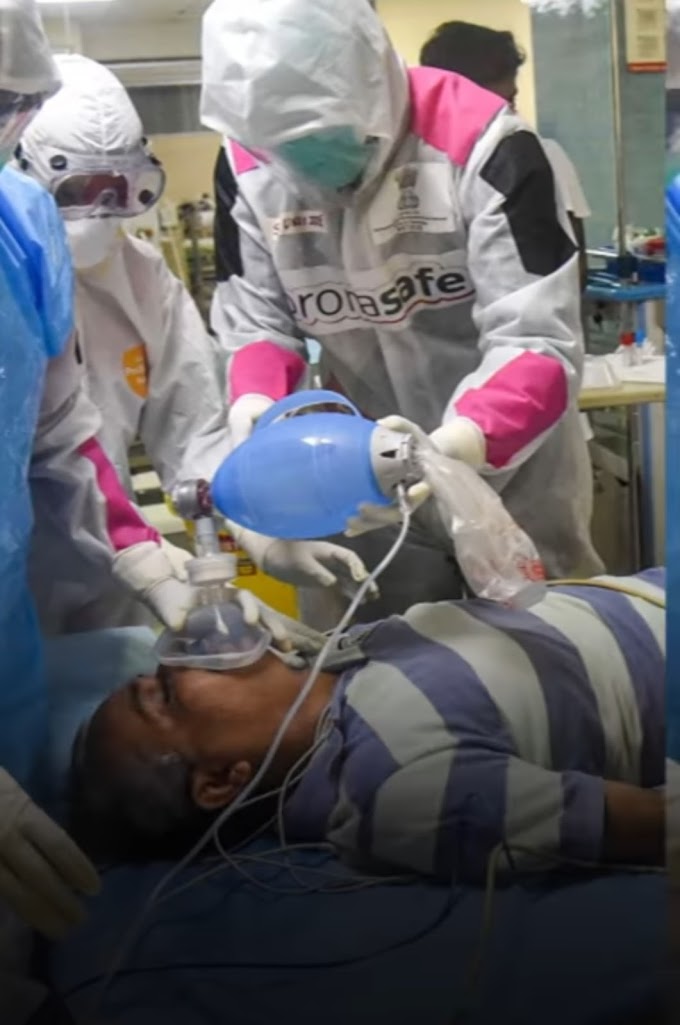

Total coronavirus patients in

India :- 12,84,638Recovered :- 8,14,912Deaths :- 30,601United States :- 41,22,672Recovered :- 19,44,490Death :- 1,46,547World :- 1,54,94,994Recovered :- 94,24,801Deaths :- 6,32,490

Lic policy jeevan shanti (850)/एलआईसी पॉलिसी जीवन शांती (850)

In this police costumer have benefit under section 80ccc.

Minimum purchase price of this policy :- INR 1,50,000

Special for handicapped dependent (divyangjan) :- policy get in 50,000/-

Single premium annuity plan:- 1.) Immediate annuity (premium get immediate)

2.) Deferred annuity (premium get after some time like 5 year later, 10 year later, 15 year later, 20 year later).

Surrender value of this policy :- after 3 months

Loan get in this policy :- after 1 year

1.) immediate annunity :- (A) immediate annuity for life

Meaning :- only police holder get pension life long.

B) immediate annuity with guaranteed period of 5 years and life thereafter

Meaning :- 5 year get defined pension for policy holder, if policy holder expired then this premium get by its nominee.

C) immediate annuity with guaranteed period of 10 years and life thereafter.

Meaning :- 10 year get defined pension for policy holder, if policy holder expired then this premium get by its nominee.

D) immediate annuity with guaranteed period of 15 years and life thereafter.

Meaning :- 15 year get defined pension for policy holder, if policy holder expired then this premium get by its nominee.

E) immediate annuity with guaranteed period of 20 years and life thereafter.

Meaning :- 20 year get defined pension for policy holder, if policy holder expired then this premium get by its nominee.

F) immediate annuity for life with return of purchase price.

Meaning :- while the policy holder is alived he or she get pension, but he or she died his/her nominee get whole sum assured with Interests.

G) immediate annuity for life increasing at a simple rate of 3% pa.

Meaning :- same as option (A), but every year pension rate increase by 3%

H) joint life immediate annuity for life with a provision for 50% of the annuity to the secondary annuitant on death of the primary annuitant.

Meaning :- while the policy holder alived he/she will get pension, if he/she died his nominee get 50% pension while the he live. If nominee died before policy holder died then no one get anything.

I) joint life immediate annuity for life with a provision for 100% of the annuity to the secondary annuitant on death of the primary annuitant.

Meaning :- while the policy holder alived he/she will get pension, if he/she died his nominee get 100% pension while the he live. If nominee died before policy holder died then no one get anything.

J) joint life immediate annuity for life with a provision for 100% of the annuity payable as long as one of the annuitant survives and return of purchase price on death of last survival.

Meaning :- in this point policy holder open his account with joint his life patner or any one he wants to join with one nominee. How live more his/her joined member how get pension live long and both died then nominee get whole amount.

2.) Deferred annuity :- (A) deferred annuity for single life

Meaning :- he decided after how much time he/she wants pension but he died before his/her decided time to get pension, then nominee get.

Purchase price + guaranteed addition - pension = total

( Pension is always zero because he/she died before his/her decided time)

B) deferred annuity for joint life

Meaning :- in this point policy holder open his account with joint his life patner or any one he wants to join with one nominee. How live more his/her joined member how get pension live long and both died then nominee get whole amount.

he decided after how much time he/she wants pension but he died before his/her decided time to get pension, then nominee get.

Purchase price + guaranteed addition - pension = total

( Pension is always zero because he/she died before his/her decided time).

If you wants to know about major preventions of coronavirus then click yes button below.

0 Comments

please do not add any spam link in the comment box